All Categories

Featured

Table of Contents

- – Employee Benefits Services Westminster, CA

- – Harmony SoCal Insurance Services

- – Payroll Services Small Business Westminster, CA

- – Employee Benefits Brokerage Firms Westminster, CA

- – Payroll Services Westminster, CA

- – Payroll Services For Small Business Westminst...

- – Payroll Service Providers Westminster, CA

- – Church Payroll Services Westminster, CA

- – Employee Benefits Consulting Westminster, CA

- – Payroll Services Near Me Westminster, CA

- – Payroll And Services Westminster, CA

- – Employee Benefits Consulting Westminster, CA

- – Best Payroll Services For Small Businesses W...

- – Payroll Service Small Business Westminster, CA

- – Payroll Service Small Business Westminster, CA

- – Harmony SoCal Insurance Services

Employee Benefits Services Westminster, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

It can additionally quickly become complicated, specifically if you're refining pay-roll alone. Several workers are unwavering in their quest for reasonable compensation. For companies, conference boosted pay demands, greater company operations costs, and the possibility of lower profits can make their companies a lot more at risk. Companies must maintain a mindful watch on their financial metrics and have a strategy to aid prevent challenges in meeting payroll obligations.

Devices that incorporate pay-roll with human resources, accounting, and time-tracking systems can automate hand-operated processes, minimizing the requirement for numerous platforms and the connected management costs. By attaching pay-roll to HR software program (Best Payroll Services For Small Businesses Westminster), services may have less administrative job, much easier access to information, boosted accuracy, and a higher degree of regulative compliance

The ROI of integrated payroll systems appears in both time saved and error reduction. Companies that take on software program like Paychex Flex, which uses assimilation with benefits, HUMAN RESOURCES, and conformity systems, might see a straight reduction in hours invested on management jobs. Automation likewise helps minimize pay-roll mistakestypically a costly problem for little businessesleading to less penalties and modifications.

Payroll Services Small Business Westminster, CA

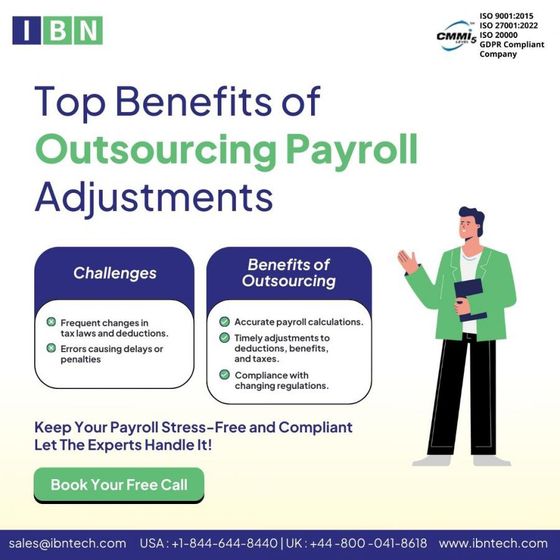

Running pay-roll is one of one of the most crucial and lengthy duties for small company owners. As your business expands, staying certified with tax regulations and taking care of deductions or advantages can come to be overwhelming. Contracting out pay-roll jobs can ease these worries. Picking the ideal payroll solution for your local business can minimize pricey mistakes and save hours monthly.

They work as an expansion of your personnels (HUMAN RESOURCES) department and use an array of pay-roll services, from standard to progressed. Listed below, we'll discuss the following: Difficulties of in-house pay-roll processing monitoring. Sorts of pay-roll tasks you handle that can be contracted out. Benefits of using a payroll service. Questions to take into consideration before outsourcing payroll.

Recognizing just how service providers deal with payroll compliance. Inquiries to ask a pay-roll carrier before choosing services. Local business deal with several obstacles when calculating and refining worker payroll and handling taxes. This is especially true if your team live in different states or nations than your firm's head office. To comprehend just how pay-roll as a solution can best aid your business, consider your personnel size, pay-roll intricacy, and internal skill degree.

Employee Benefits Brokerage Firms Westminster, CA

The U.S. Bureau of Labor Stats lists the average spend for an accounting professional as $79,880 each year, not consisting of benefits. And also, you might still utilize HR software program to procedure payroll. The IRS evaluated over $65.5 billion in civil penalties in the 2023 monetary year. Greater than $8.5 billion in fines were imposed on business for work tax issues.

There are a number of actions associated with the little service pay-roll procedure, and pay-roll solutions for small organizations. Best Payroll Services For Small Businesses Westminster can take control of some or every one of these tasks. Employers determine the staff member's gross pay, keep or garnish wages as required, and send out paychecks. You might additionally need to follow government and state policies, such as the Family and Medical Leave Act (FMLA), depending upon the size of your company.

These applications include DIY and full-service solutions for running payroll and tax obligation declaring. Can assist with payroll. They determine staff member pay and pay-roll taxes and keep records.

Payroll Services Westminster, CA

Some offer certified pay-roll reporting if you service government agreements. The ideal pay-roll providers update their software program regularly to reflect work legislation modifications, consisting of regulations for paid leave, overtime, and advantages qualification. Numerous have built-in compliance tracking devices and alerts for tax obligation deadlines and labor regulation changes. Seek payroll solution suppliers that use tax declaring assurances and specialized support reps or payroll tax obligation conformity specialists.

See if the software program uses multistate pay-roll administration or worldwide services. When you meet pay-roll carriers for an on-line demonstration or follow-up conference, have a listing of inquiries prepared. Take a look at the vendor's most current updates and current pay-roll trends to see if you have any kind of brand-new problems. Right here are concerns to assist you evaluate functionality, assimilation, and conformity in a little business pay-roll service provider: See if the company has an accuracy warranty, if it covers fines or fees, and just how promptly they resolve errors.

Whether you're a start-up or an enterprise-level company, effective payroll software application is essential. It isn't constantly affordable to work with an in-house team to manage pay-roll, especially for organizations with a tiny head count. Signing up for a specialist payroll process not just ensures that you pay employees properly and on schedule, yet additionally allows your organization to stay certified with an ever-changing tax obligation code.

Payroll Services For Small Business Westminster, CA

In this blog site, we're mosting likely to explore the necessary variables to think about when choosing a payroll software application and listing the 10 finest pay-roll software program for small organizations' requirements. Small companies have particular pay-roll requires many thanks to challenges such as growing headcount, limited sources, and an absence of internal pay-roll know-how.

Elements to think about when picking a pay-roll software program include headcount, budget plan, and tax obligation conformity. Payroll software program should not include even more time to tasks like invoicing, pay-roll reports, or benefits administration. Seek a straightforward interface that enhances typical pay-roll services, along with self-service capacities for onboarding and consumer assistance. Not every pay-roll service company is alike in terms of rates.

The lack of openness over pricing is a typical critique of ADP, as well as core pay-roll functions such as fringe benefit monitoring just being readily available as attachments. Nevertheless, it obtains appreciation for ease of use and personalized pay-roll records. Established in 1971, Paychex is a relied on name in the payroll and HR space.

With 3 pricing plans, it's simple for entrepreneur to discover the right pay-roll service for their needs. All strategies automate the payroll procedure and tax obligation filing services for staff member and contractor settlements, as well as employee self-service for accessibility to tax return and pay stubs. The Essentials plan starts at $39 monthly, adhered to by $44 each month for Select and $89 per month for Pro.

Payroll Service Providers Westminster, CA

Released in 2012 as ZenPayroll, Gusto's automatic pay-roll solution currently offers even more than 300,000 services.

QuickBooks Payroll likewise partners with SimplyInsured to use wellness insurance policy benefits. All plans have a base cost for bookkeeping attributes, with the pay-roll feature available for an additional expense. QuickBooks offers among the most affordable pay-roll strategies on the market at $15 per month, which consists of fundamental functions including tax reductions and basic reporting.

Secret functions consist of three-day straight deposit, time tracking, a self-service site, and a totally free payroll test. Nonetheless, Wave does not use automatic pay-roll in all 50 states. SurePayroll was developed in 2000 and became a subsidiary of Paychex, Inc. in 2011. It offers a different to Paychex Flex for services that need a full-service service with human resources functions.

Church Payroll Services Westminster, CA

The benefits of Patriot consist of no long-term agreements and unrestricted payroll runs. Organizations have a choice of 2 pay-roll plans; The Standard strategy is $17 per month (+ $4 per individual) and covers standard service requirements such as two-day straight deposit, as well as an integration with QuickBooks Online.

The full plan additionally assures tax obligation filing accuracy, offering services an additional layer of security. Nonetheless, a drawback is that Patriot does not use any kind of HR and benefits solutions. OnPay is a cloud-based pay-roll and HR remedy established in 2007. OnPay supplies among the simplest payroll procedures on the market, with a single plan retailing at $40 each month + $6 each.

The Zenefits payroll software application is a thorough plan that consists of endless pay runs, several pay routines, and benefits reductions. Rates by headcount makes Zenefits really adaptable for organizations, as it isn't possible to outgrow your strategy. But today, there is no choice to simply sign up for the pay-roll feature.

Payroll software application might not be the most interesting subject, however it is essential for any kind of company with employees. By picking a payroll service provider that aligns with crucial organization requirements and objectives, you can turn away from tax obligation documents and spread sheets and instead concentrate on growing your organization.

Employee Benefits Consulting Westminster, CA

Not every pay-roll solution offers the same pricing framework. It's vital to assess what details functions you need so you don't pay for tools you aren't making use of. A full-service pay-roll system might set you back even more, yet it may be excessive for several local business. A scalable payroll system permits you to upgrade strategies for even more capability or sign up for add-on services as your company expands.

A good payroll option offers automatic tax obligation calculations for all levels of tax obligations and stays upgraded with guideline adjustments. It is valuable to opt for a payroll service provider that likewise consists of year-end tax filing solutions. Assimilation capabilities enable for the simple sharing of information in between systems. This makes certain entrepreneur and human sources employees have accessibility to important information when they need it.

Small companies can then concentrate extra on growth and much less on administrative tasks. Eric Simmons is a development advertising and need generation professional acting as the Elderly Supervisor of Development Marketing at Stax. During his period below, Eric has actually been crucial in pushing the firm's impressive development, leveraging his competence to accomplish significant milestones over the previous 6 years.

Payroll Services Near Me Westminster, CA

Focus on systems that deal with deductions, contributions, and entries straight to tax obligation authorities to reduce mistakes. Select suppliers that offer websites where personnel can access pay stubs, upgrade their details, and send requests independently.

Allow's go through discovering the appropriate pay-roll carrier for your small business, beginning with functions and ending with what to seek in a service provider. There are a great deal of pay-roll alternatives readily available for local business. Best Payroll Services For Small Businesses Westminster. Nonetheless, knowing what to search for can be challenging, and it can be appealing to pick based upon price alone.

In addition, an all-encompassing payroll system is keyed to expand with you, offering a complete array of capacities that can progress with your organization. Due to the fact that your demands are one-of-a-kind, you require a carrier that flawlessly fits your organization's operations.

Payroll And Services Westminster, CA

Discover a little company pay-roll company recognized for client service. When you have questions, you ought to understand that to call and trust you'll get a solution. Search for a pay-roll supplier that will supply a committed support team so you know you're getting the responses you need quickly. Search for a supplier that supplies attendant service and adjustable assistance throughout the onboarding duration.

Secret functions include three-day direct down payment, time tracking, a self-service portal, and a cost-free payroll trial. Wave does not offer computerized pay-roll in all 50 states.

The benefits of Patriot include no long-lasting agreements and endless pay-roll runs. Businesses have a selection of two payroll strategies; The Standard strategy is $17 per month (+ $4 per individual) and covers basic organization requirements such as two-day direct down payment, as well as a combination with QuickBooks Online.

Employee Benefits Consulting Westminster, CA

OnPay is a cloud-based payroll and HR solution founded in 2007. OnPay supplies one of the easiest payroll processes on the market, with a solitary strategy retailing at $40 per month + $6 per person.

The Zenefits payroll software program is an extensive plan that includes limitless pay runs, numerous pay schedules, and benefits reductions. Pricing by head count makes Zenefits extremely adaptable for services, as it isn't feasible to outgrow your strategy. But at present, there is no choice to just register for the pay-roll function.

Pay-roll software might not be the most amazing subject, but it is vital for any type of organization with employees. By choosing a payroll provider that straightens with crucial company requirements and goals, you can transform away from tax obligation documents and spread sheets and rather concentrate on growing your organization. One more way to enhance and save time, energy, and cash in your service is to guarantee you are getting the best credit card handling rates for your service needs.

Best Payroll Services For Small Businesses Westminster, CA

A full-service pay-roll system may set you back even more, but it may be overkill for many tiny companies. A scalable payroll system enables you to upgrade plans for more capability or subscribe to add-on solutions as your service grows.

A good pay-roll solution provides automatic tax obligation computations for all levels of taxes and remains updated with regulation modifications. It is beneficial to decide for a payroll provider that also consists of year-end tax obligation declaring services.

Payroll Service Small Business Westminster, CA

Small companies can after that concentrate a lot more on growth and much less on management tasks. Eric Simmons is a growth advertising and demand generation experienced working as the Elderly Supervisor of Development Advertising And Marketing at Stax. Throughout his tenure below, Eric has contributed in driving the business's amazing development, leveraging his proficiency to accomplish considerable turning points over the previous 6 years.

Choose for systems that fit adding staff members or specialists in new areas without needing pricey upgrades. Prioritize systems that manage reductions, payments, and submissions directly to tax obligation authorities to decrease errors. Select providers that provide portals where staff can access pay stubs, upgrade their information, and submit demands individually. Prevent per-employee fees or concealed costs.

Let's go through discovering the right pay-roll carrier for your small company, beginning with features and finishing with what to try to find in a supplier. There are a great deal of pay-roll options available for local business. However, understanding what to search for can be difficult, and it can be appealing to select based on cost alone.

Furthermore, an all-encompassing payroll system is topped to expand with you, supplying a complete range of capabilities that can progress with your company. Due to the fact that your demands are one-of-a-kind, you need a company that seamlessly fits your organization's operations.

Payroll Service Small Business Westminster, CA

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Discover a small service payroll provider known for customer solution. Look for a payroll vendor that will give a committed assistance group so you recognize you're getting the answers you need swiftly.

Payroll Service For Small Businesses Westminster, CAEmployee Benefits Consulting Westminster, CA

Payroll Services Near Me Westminster, CA

Local Seo Near Me Westminster, CA

Near Me Seo Consultant Westminster, CA

Best Payroll Services For Small Businesses Westminster, CA

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Services Westminster, CA

- – Harmony SoCal Insurance Services

- – Payroll Services Small Business Westminster, CA

- – Employee Benefits Brokerage Firms Westminster, CA

- – Payroll Services Westminster, CA

- – Payroll Services For Small Business Westminst...

- – Payroll Service Providers Westminster, CA

- – Church Payroll Services Westminster, CA

- – Employee Benefits Consulting Westminster, CA

- – Payroll Services Near Me Westminster, CA

- – Payroll And Services Westminster, CA

- – Employee Benefits Consulting Westminster, CA

- – Best Payroll Services For Small Businesses W...

- – Payroll Service Small Business Westminster, CA

- – Payroll Service Small Business Westminster, CA

- – Harmony SoCal Insurance Services

Latest Posts

Electric Tankless Water Heater Installation Near Me Sabre Springs San Diego

Hot Water Heater Replacement University City San Diego

Plumbers In Carmel Mountain Ranch

Latest Posts

Electric Tankless Water Heater Installation Near Me Sabre Springs San Diego

Hot Water Heater Replacement University City San Diego

Plumbers In Carmel Mountain Ranch