All Categories

Featured

Table of Contents

- – Harmony SoCal Insurance Services

- – Original Medicare Explained: Core Basics

- – What Part A and Part B Cover

- – Deductibles and Costs in Original Medicare

- – Provider Flexibility and Doctor Choice

- – Understanding Medicare Advantage Part C

- – Medicare Advantage Plan Structure

- – Common Medicare Advantage Extras

- – Prescription Drug Integration

- – Medicare Advantage vs Original Medicare: Side-...

- – Comparing Costs

- – Coverage Comparison

- – Provider Choice Comparison

- – Travel and Flexibility

- – Advantages and Disadvantages of Original Medicare

- – Key Advantages

- – Common Drawbacks

- – When Original Medicare Makes Sense

- – Advantages and Disadvantages of Medicare Advan...

- – Key Advantages

- – Common Drawbacks

- – When Medicare Advantage Makes Sense

- – Deciding Between Original Medicare and Medicar...

- – Factors to Consider

- – Enrollment Periods and Switching Rules

- – Local Plan Availability and Star Ratings

- – Common Questions on Medicare Advantage vs Orig...

- – Areas We Serve Throughout Southern California

- – Frequently Asked Questions (FAQ)

- – What's the primary difference between Origina...

- – Does Medicare Advantage cost less than Origin...

- – Can I keep my doctor with Medicare Advantage ...

- – Is dental and vision included in Medicare Adv...

- – What are the switching rules from Medicare Ad...

- – How much is the maximum out-of-pocket in Medi...

- – What's the enrollment process for Medicare Ad...

- – Do zero-premium Medicare Advantage plans exis...

- – How does dual-eligible status work in Califor...

- – How have costs changed for prescription cover...

- – We Can Help! Contact Us Today

- – Harmony SoCal Insurance Services

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Original Medicare vs Medicare Advantage is one of the most important healthcare decisions seniors face. Many people in Southern California ask the same questions: How do Original Medicare and Medicare Advantage differ? Would Medicare Advantage suit me better than Original Medicare for my doctors, prescriptions, or budget? From Orange County to San Diego, residents want clear answers on provider choice, out-of-pocket costs, and extras like dental, vision, and hearing coverage. This guide explains Original Medicare vs Medicare Advantage using reliable CMS data so you can make an informed decision about the plan that fits your health needs and lifestyle.

The decision affects your daily medical access and long-term financial security. Original Medicare offers nationwide flexibility, while Medicare Advantage offers integrated protections and added benefits. Both deliver strong coverage, but their differences help identify the best match for your situation.

Original Medicare Explained: Core Basics

Original Medicare is the traditional government-administered program that includes Part A (hospital insurance) and Part B (medical insurance). It uses a fee-for-service model with broad provider acceptance across the country. According to Medicare.gov, nearly all doctors and hospitals nationwide participate.

What Part A and Part B Cover

Part A covers inpatient hospital stays, skilled nursing facility care, hospice, and some home health services. Part B handles doctor visits, outpatient care, preventive services, and durable medical equipment. Preventive screenings and wellness visits are included at no extra cost.

Hospital coverage includes deductibles and coinsurance for longer stays. Medical services require 20% coinsurance after deductible. Preventive services encourage early detection without financial barriers

Deductibles and Costs in Original Medicare

Most pay a standard Part B premium, with income-based adjustments for higher earners. An annual deductible applies before coverage begins. There is no out-of-pocket maximum, so coinsurance continues on approved services.

Premiums are consistent, yet significant care raises expenses. Many add supplemental coverage for greater security.

Provider Flexibility and Doctor Choice

You can visit any provider nationwide that accepts Medicare without referrals. This freedom supports established doctor relationships and travel needs.

No network restrictions simplify specialist access. Nationwide acceptance ensures continuity during moves or visits.

Original Medicare offers reliable flexibility many value. Learn about Medigap plans to fill coverage gaps.

Understanding Medicare Advantage Part C

Medicare Advantage is a private plan alternative approved by CMS that covers everything in Original Medicare and often adds extras. Plans frequently include prescription drugs and have an out-of-pocket maximum of $9,250. KFF notes many plans keep additional premiums low.

Medicare Advantage Plan Structure

Plans use networks: HMOs focus on in-network providers, while PPOs allow out-of-network care at higher costs. Private insurers manage administration under federal rules.

HMO coordination promotes integrated care. PPOs provide out-of-network choices. Quality oversight ensures standards are met.

Common Medicare Advantage Extras

Nearly all plans include routine dental, vision, and hearing coverage. Fitness memberships, telehealth, and transportation services are common additions.

Dental benefits cover exams and procedures. Vision coverage offers eyewear support. Hearing support helps with aids and exams.

Prescription Drug Integration

Most plans bundle Part D coverage with defined spending limits. Formularies organize medications into cost tiers for savings.

Integration simplifies refills and adherence. Thresholds protect against high drug costs.

Medicare Advantage offers coordinated value. See Medicare Advantage plans in Southern California for local options.

Medicare Advantage vs Original Medicare: Side-by-Side Comparison

Side-by-side review of Original Medicare vs Medicare Advantage highlights key differences in costs, benefits, and access.

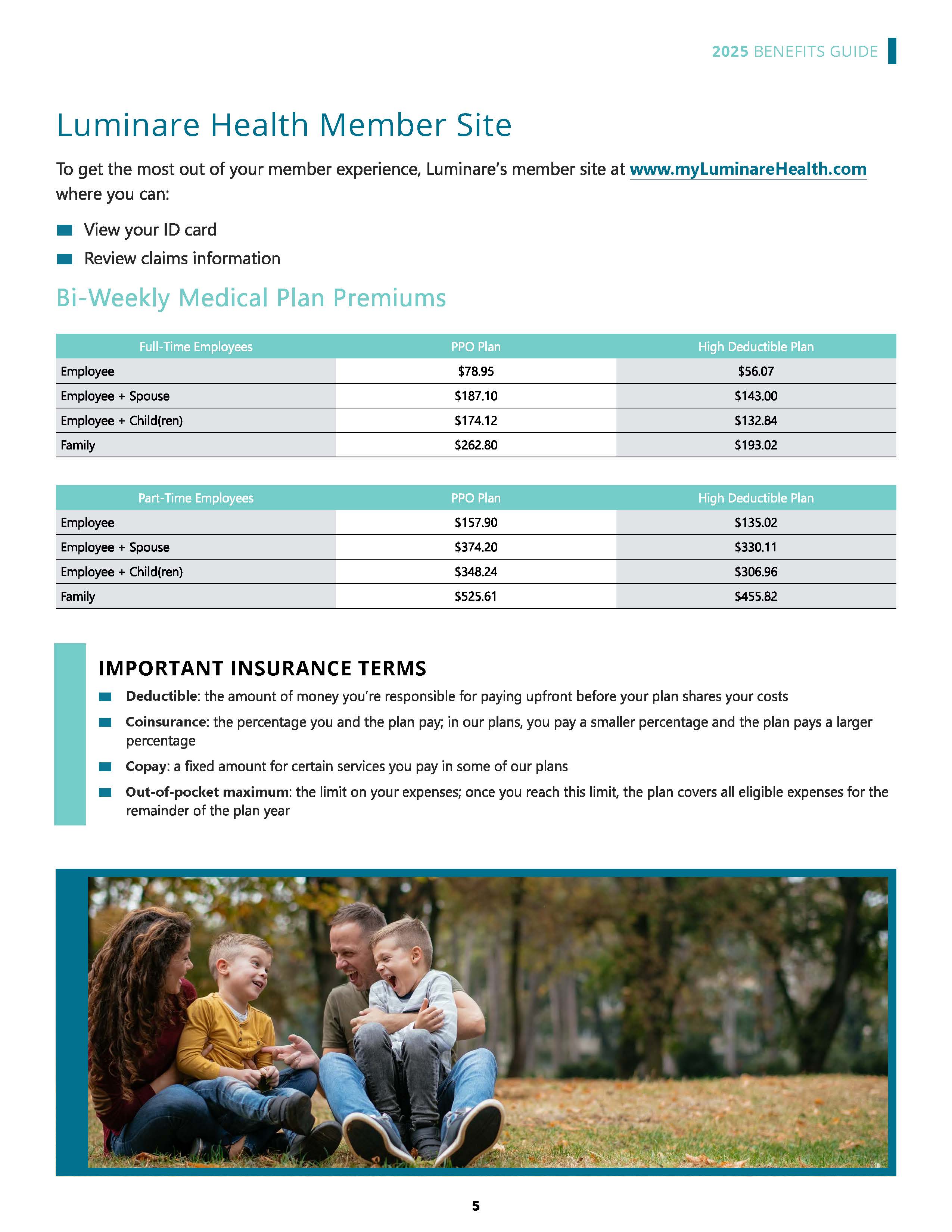

Comparing Costs

Original Medicare has standard premiums and unlimited coinsurance. Medicare Advantage (Best Health Insurance Plans For Self Employed Brea) often features zero additional premiums with capped annual costs

Zero-premium options are widespread. Caps provide spending certainty. Deductibles vary but include protection.

Coverage Comparison

Core services are identical. Medicare Advantage adds extras like dental and vision in nearly all plans.

Drug coverage is usually built-in. Supplemental benefits enhance daily health. Wellness programs promote prevention.

Provider Choice Comparison

Original offers nationwide choice. Advantage uses networks for coordination.

Nationwide access suits travel. Local networks foster integrated care.

Travel and Flexibility

Emergencies are covered everywhere. Routine travel works better with unrestricted access.

Global emergencies qualify under both. Domestic routine favors nationwide models.

Comparisons clarify priorities. Review Medicare Part D for drug details.

| Feature | Harmony SoCal Insurance Services | Typical Competitor |

|---|---|---|

| Plan Review Speed | Same-day consultation | 3–7 day wait |

| Provider Confirmation | 100% confirmation | Directory only |

| Satisfaction Guarantee | Full switch support | Limited help |

| Local Expertise | Southern California focus | National call center |

Advantages and Disadvantages of Original Medicare

Original Medicare prioritizes choice but requires planning for exposures.

Key Advantages

Nationwide provider access preserves relationships. No referrals speed specialist visits. Uniform rules ensure consistency.

Common Drawbacks

No out-of-pocket cap creates risk. Separate drug coverage adds steps. Routine extras need other policies.

When Original Medicare Makes Sense

Travelers and those with multi-state doctors benefit most. Established care teams stay intact.

Supplements enhance protection. See senior dental and vision plans.

Advantages and Disadvantages of Medicare Advantage

Medicare Advantage emphasizes integration and financial boundaries.

Key Advantages

Caps protect finances. Extras promote wellness. Premiums often stay low.

Common Drawbacks

Networks guide choices. Authorizations ensure necessity. Plans change annually.

When Medicare Advantage Makes Sense

Budget-focused seniors gain predictability. Those wanting extras find integration valuable.

Medicare Advantage provides coordinated support. Explore dual-eligible options.

Deciding Between Original Medicare and Medicare Advantage in SoCal

Your choice depends on health needs, doctors, and benefit priorities.

Factors to Consider

Review medications and conditions. Best Health Insurance Plans For Self Employed Brea. Check doctor participation. Evaluate routine service needs

Enrollment Periods and Switching Rules

Annual Enrollment is the main window. Advantage periods allow mid-year changes. Life events trigger special enrollment.

Local Plan Availability and Star Ratings

Regional plans vary in strength. Ratings guide quality. Dual coordination helps qualifying residents.

Local knowledge reveals best fits. See wellness incentives.

Common Questions on Medicare Advantage vs Original Medicare

Financial exposure resolves with caps or supplements. Doctor continuity secures through verification. Extras integrate seamlessly.

Enrollment guidance simplifies timing. Targeted support builds confidence.

Contact our team for solutions.

Areas We Serve Throughout Southern California

We serve Orange County, Los Angeles, Inland Empire, Riverside, San Bernardino, San Fernando, Ventura, and San Diego with localized expertise.

Frequently Asked Questions (FAQ)

What's the primary difference between Original Medicare and Medicare Advantage?

Original Medicare offers government Parts A and B with nationwide choice but no cap. Medicare Advantage bundles benefits with extras and a $9,250 limit. See HMO vs PPO plans.

Does Medicare Advantage cost less than Original Medicare?

It depends on usage. Original has ongoing coinsurance; Advantage often has zero premiums and caps. Review ACA plans for transitions.

Can I keep my doctor with Medicare Advantage in Southern California?

Networks include most providers. Verification ensures continuity. See our carriers.

Is dental and vision included in Medicare Advantage?

Nearly all plans include routine services. Explore dental and vision options.

What are the switching rules from Medicare Advantage to Original Medicare?

During Annual or Advantage Enrollment periods. Check our process.

How much is the maximum out-of-pocket in Medicare Advantage?

$9,250 in-network, often lower. Consider cancer insurance.

What's the enrollment process for Medicare Advantage in Orange County?

Licensed help reviews options. Visit talk to us.

Do zero-premium Medicare Advantage plans exist locally?

Many bundle comprehensive benefits. See senior insurance.

How does dual-eligible status work in California?

Coordinated integration enhances coverage. Discover dual benefits.

How have costs changed for prescription coverage?

Integrated thresholds offer relief. Review Part D.

We Can Help! Contact Us Today

Understanding Original Medicare vs Medicare Advantage brings clarity and confidence. Capped costs and extras provide emotional relief, while premium savings and coordination deliver logical value.

One San Diego resident shared: “Caps and dental coverage transformed my retirement security.” Linda in Ventura noted: “My doctors stayed, and wellness perks improved life.”

Harmony SoCal Insurance Services offers licensed guidance since 2015 with a Satisfaction Guarantee.

2135 N Pami Cir, Orange, CA 92867

(714) 922-0043

Ready for worry-free coverage? Harmony SoCal Insurance Services specializes in Original Medicare vs Medicare Advantage across Southern California. Complimentary consultations ensure the right fit. Connect today.

2135 N Pami Cir, Orange, CA 92867

(714) 922-0043

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: info@hsocal.com

Harmony SoCal Insurance Services

Human Resources And Payroll Services Brea, CA

Employee Benefits Consulting Company Brea, CA

Funeral Expense Insurance For Seniors Brea, CA

Best Payroll Service Brea, CA

Dental And Vision Insurance For Seniors Brea, CA

Health Insurance Plans For Students Brea, CA

Best Dental Insurance For Seniors On Medicare Brea, CA

Hr & Payroll Services Brea, CA

Senior Citizens Insurance Brea, CA

Vision Insurance For Seniors On Medicare Brea, CA

Company Health Insurance Plans Brea, CA

Senior Insurance Services Brea, CA

Best Payroll Service Brea, CA

Best Dental Insurance For Seniors On Medicare Brea, CA

Vision Insurance For Seniors On Medicare Brea, CA

Vision Insurance For Seniors On Medicare Brea, CA

Contractor Payroll Services Brea, CA

Final Expense Insurance For Seniors Brea, CA

Individual Health Insurance Plans Brea, CA

Vision Insurance For Seniors On Medicare Brea, CA

Employee Benefits Consulting Company Brea, CA

Vision Insurance For Seniors On Medicare Brea, CA

Final Expense Insurance For Seniors Brea, CA

Contractor Payroll Services Brea, CA

Funeral Insurance For Seniors Brea, CA

Vision Insurance For Seniors On Medicare Brea, CA

Best Private Health Insurance Plans Brea, CA

Health Insurance Plans For Students Brea, CA

Cheap Term Insurance For Seniors Brea, CA

Find A Seo Services For Business Brea, CA

Finding A Good Local Seo Firm Brea, CA

Harmony SoCal Insurance Services

Best Payroll Service Brea, CA

Cheap Term Insurance For Seniors Brea, CA

Table of Contents

- – Harmony SoCal Insurance Services

- – Original Medicare Explained: Core Basics

- – What Part A and Part B Cover

- – Deductibles and Costs in Original Medicare

- – Provider Flexibility and Doctor Choice

- – Understanding Medicare Advantage Part C

- – Medicare Advantage Plan Structure

- – Common Medicare Advantage Extras

- – Prescription Drug Integration

- – Medicare Advantage vs Original Medicare: Side-...

- – Comparing Costs

- – Coverage Comparison

- – Provider Choice Comparison

- – Travel and Flexibility

- – Advantages and Disadvantages of Original Medicare

- – Key Advantages

- – Common Drawbacks

- – When Original Medicare Makes Sense

- – Advantages and Disadvantages of Medicare Advan...

- – Key Advantages

- – Common Drawbacks

- – When Medicare Advantage Makes Sense

- – Deciding Between Original Medicare and Medicar...

- – Factors to Consider

- – Enrollment Periods and Switching Rules

- – Local Plan Availability and Star Ratings

- – Common Questions on Medicare Advantage vs Orig...

- – Areas We Serve Throughout Southern California

- – Frequently Asked Questions (FAQ)

- – What's the primary difference between Origina...

- – Does Medicare Advantage cost less than Origin...

- – Can I keep my doctor with Medicare Advantage ...

- – Is dental and vision included in Medicare Adv...

- – What are the switching rules from Medicare Ad...

- – How much is the maximum out-of-pocket in Medi...

- – What's the enrollment process for Medicare Ad...

- – Do zero-premium Medicare Advantage plans exis...

- – How does dual-eligible status work in Califor...

- – How have costs changed for prescription cover...

- – We Can Help! Contact Us Today

- – Harmony SoCal Insurance Services

Latest Posts

Coachella Home Care For Seniors

Senior Home Companions Warner Springs

Care Companies Coachella

More

Latest Posts

Coachella Home Care For Seniors

Senior Home Companions Warner Springs

Care Companies Coachella